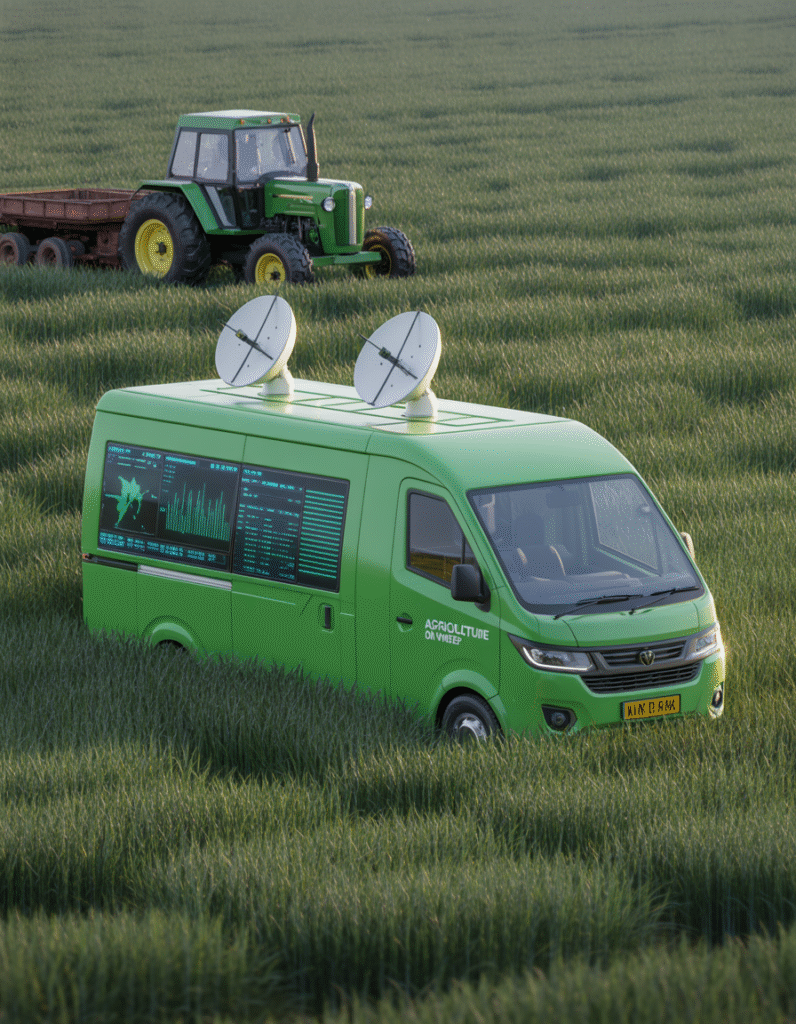

Agriculture Lab on Wheels Punjab: Transforming Farm Services Through Mobile Innovation

Agriculture Lab on Wheels Punjab marks a major step forward in Pakistan’s agricultural modernization, as the Punjab government rolls out mobile agricultural laboratories designed to deliver critical farm services directly to farmers’ doorsteps. The initiative reflects a growing shift toward technology-driven, farmer-centric solutions aimed at improving productivity, sustainability, and crop planning across the province. Read Mote: https://theboardroompk.com/punjab-food-authority-seizes-thousands-of-rotten-eggs-in-lahore/ Approved by the Punjab government under the leadership of Chief Minister Maryam Nawaz Sharif, the programme focuses on improving access to real-time soil and water testing—key inputs that directly influence crop yield, fertilizer use, and irrigation efficiency. Agriculture Lab on Wheels Punjab to Operate in 15 Districts Under the Agriculture Lab on Wheels Punjab initiative, mobile laboratories will initially be deployed across 15 districts, offering on-the-spot soil and water analysis. These labs eliminate the traditional delays and costs farmers face when sending samples to distant testing facilities. Through immediate testing and reporting, farmers will be able to: • Assess soil fertility accurately• Identify nutrient deficiencies• Evaluate water quality for irrigation• Make data-backed decisions on fertilizer application and crop selection This direct access to scientific data is expected to significantly enhance farm-level decision-making and reduce unnecessary input costs. Central Monitoring and Digital Oversight for Transparency To ensure efficiency and accountability, the Punjab government has established a central control room that will monitor the performance of all mobile laboratories. This centralized system will oversee scheduling, service quality, data accuracy, and operational transparency. Such digital oversight not only improves coordination but also builds trust among farmers by ensuring standardized and reliable testing results across districts. 100 Farmer Facilitation Centres to Complement Mobile Labs In addition to the Agriculture Lab on Wheels Punjab, the provincial government has approved the establishment of 100 container-based farmer facilitation centres across all districts. These centres will function as localized agricultural support hubs, equipped with: • Agriculture officers and technical experts• Digital advisory tools• Data call centres for real-time guidance• Access to government schemes and subsidies By combining mobile labs with permanent facilitation centres, Punjab is creating a hybrid service model that strengthens both outreach and continuity of agricultural advisory services. Driving Record Wheat Production and Farmer Welfare Chief Minister Maryam Nawaz Sharif expressed confidence that initiatives like Agriculture Lab on Wheels Punjab would help achieve a record wheat yield during the current season. Improved soil diagnostics, water management, and advisory support are expected to directly translate into higher productivity and better crop outcomes. She further highlighted that additional farmer welfare programmes are already underway, including: • The Kissan Card Scheme for financial inclusion• Tractor-related projects to improve mechanization• Subsidized agricultural inputs Together, these measures demonstrate a comprehensive policy approach to strengthening Punjab’s agricultural economy and improving rural livelihoods. Sindh Government Launches Affordable Seed and Geo-Marking Initiative While Punjab advances mobile agricultural services, the Sindh government has also announced major reforms to support farmers. The Sindh administration has decided to provide quality seeds at affordable prices throughout the province, ensuring better access to certified inputs. Additionally, the Sindh Seed Corporation will implement geo-marking of agricultural lands, a move aimed at: • Improving resource management• Enhancing crop planning accuracy• Supporting data-driven agricultural policies This initiative will enable more efficient allocation of inputs and long-term productivity improvements across Sindh. A New Era of Smart Agriculture in Pakistan The launch of Agriculture Lab on Wheels Punjab, alongside Sindh’s seed and geo-marking initiatives, signals a broader national shift toward smart agriculture. By integrating mobile technology, digital monitoring, and on-ground advisory services, provincial governments are addressing long-standing challenges faced by farmers. These reforms not only strengthen food security but also position agriculture as a modern, data-enabled sector capable of driving sustainable economic growth.