This Pakistan’s Internet IoT Company Expands Overseas with UAE Collaboration in Maritime Connectivity

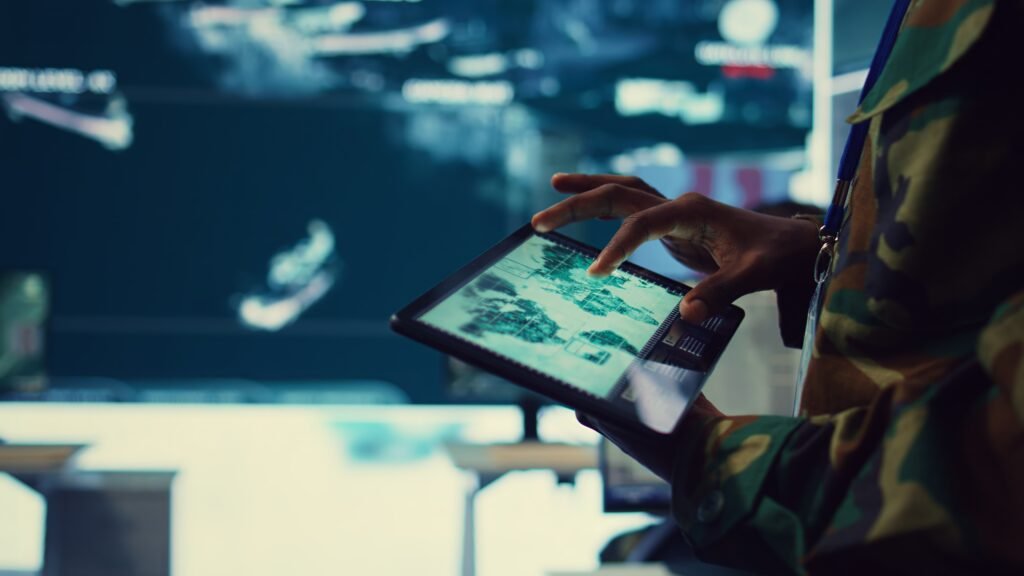

Karachi, December 15, 2025 – Pakistan’s leading telecommunications provider, Supernet Limited, has taken a significant step towards international expansion by signing a joint collaboration agreement through its wholly-owned UAE subsidiary, Phoenix Global FZE (PGF).The agreement, effective from December 9, 2025, partners PGF with Athena Telecommunications Equipment Trading Co. L.L.C. (Athena Telecom), a UAE-based firm. The three-year pact, renewable by mutual consent, focuses on promoting and delivering advanced solutions in maritime connectivity, safety, security, earth observation, Internet of Things (IoT), and related digital infrastructure across regional and international markets. Read More: https://theboardroompk.com/pibt-and-reko-diq-sign-landmark-agreement-to-enable-multi-billion-dollar-mineral-exports-from-pakistan/ Key features include co-branded offerings, joint sales and marketing initiatives, and project-based revenue-sharing models. This collaboration leverages Athena Telecom’s strong technical expertise alongside Supernet’s established commercial presence to tap into the rapidly growing global maritime connectivity sector.Founded in 1995 and listed on the GEM Board of the Pakistan Stock Exchange (PSX), Supernet is one of Pakistan’s pioneering telecommunications service providers and systems integrators. The company notified the PSX of the development, stating: “In line with the company’s objective to increase its footprints beyond Pakistan… the collaboration enables Supernet Limited—through Phoenix Global FZE—to enter the large and growing global maritime connectivity markets, and expand regional and international revenue streams.”While the immediate financial impact remains uncertain and dependent on specific projects, Supernet anticipates positive long-term commercial benefits from this strategic move.This overseas push comes as Pakistani tech firms increasingly seek diversification amid domestic economic challenges, highlighting opportunities in the Middle East’s booming digital and maritime sectors.