Global smartphone shipments grew modestly by 2% year-on-year in 2025, driven by stronger consumer demand and economic momentum in emerging markets, according to fresh data from Counterpoint Research released on January 12, 2026.

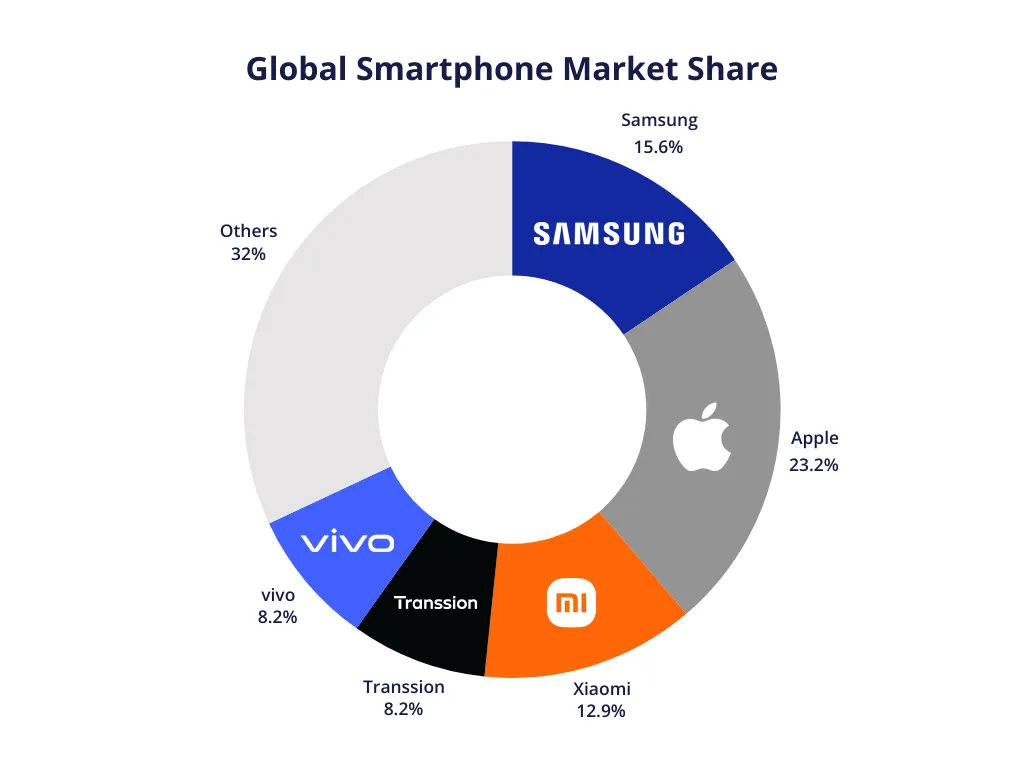

Apple reclaimed the leading position, securing a 20% market share—the highest among the top five vendors—thanks to robust performance across emerging and mid-sized markets and exceptional sales of the iPhone 17 series.

Counterpoint analyst Varun Mishra highlighted Apple’s success in penetrating price-sensitive regions while maintaining premium appeal. The iPhone 17 lineup, featuring enhanced features trickling down to base models, contributed significantly to sustained demand throughout the year.

Manufacturers also front-loaded shipments early in 2025 to mitigate potential tariff impacts, though this effect diminished in the second half, resulting in stable volumes later on.

Vendor Rankings and Market Dynamics

Samsung held second place with a 19% share, achieving modest shipment growth amid competitive pressures. Xiaomi ranked third with 13%, benefiting from consistent strength in emerging markets through affordable yet feature-rich devices.

The overall market expansion reflected recovery in key regions, with emerging economies playing a pivotal role in offsetting slower growth in mature markets.

This marks a notable shift, as earlier forecasts from Counterpoint (November 2025) projected Apple nearing or surpassing Samsung at around 19.4%, but final 2025 figures confirm Apple’s clear lead at 20%. The premium segment, led by Apple, continued to outperform budget categories.

Challenges Ahead for 2026

Looking forward, Counterpoint research director Tarun Pathak cautioned that the global smartphone market could soften in 2026 due to chip shortages and escalating component costs.

Chipmakers are increasingly prioritizing AI data centers over consumer devices, potentially constraining supply and raising prices. Despite 2025’s positive momentum, geopolitical factors like tariffs and macroeconomic uncertainties may temper future growth.

The report underscores Apple’s strategic resilience in diversifying beyond traditional strongholds, positioning it well even as industry headwinds loom.