IMF Pakistan fiscal projections point to a significant reshaping of the country’s public finances through FY2030, with lower interest payments offering limited fiscal relief while development spending continues to shrink and defence expenditure steadily rises.

According to the International Monetary Fund’s latest review under Pakistan’s $7 billion Extended Fund Facility (EFF), improving fiscal space has not translated into higher development allocations. Instead, the government faces difficult trade-offs between debt servicing, security needs, and long-term economic investment.

IMF Pakistan Fiscal Projections on Interest Payments Ease Pressure

One of the most notable takeaways from the IMF Pakistan fiscal projections is the gradual decline in interest payments as a share of GDP, largely due to easing policy rates.

In FY25, interest payments stood at 7.8 percent of GDP, slightly higher than initial estimates. However, for the current fiscal year, the IMF has revised this figure downward to 6.5 percent, reflecting monetary easing.

Looking ahead, interest payments are projected to fall consistently:

• FY27: 5.9 percent of GDP

• FY28: 5.2 percent

• FY29: 5.1 percent

• FY30: 4.8 percent

In absolute terms, interest costs are expected to hover around Rs8.2 trillion over the next two years before rising gradually to Rs9.3 trillion by FY30. This stabilisation, however, does not necessarily free up space for development spending.

Shrinking PSDP a Key Concern in IMF Pakistan Fiscal Projections

Despite improving debt indicators, the Public Sector Development Programme (PSDP) remains under severe pressure.

The IMF noted that PSDP spending was originally set at 0.9 percent of GDP in FY25, but was cut to 0.7 percent to offset revenue shortfalls. This reduced allocation continues into the current fiscal year.

Alarmingly, IMF Pakistan fiscal projections show PSDP falling further to 0.6 percent of GDP next year, a level expected to persist through FY2030.

In rupee terms, development spending tells a similar story. PSDP allocations dropped from an original estimate of Rs1.065 trillion to Rs873 billion in the current year. Over the medium term, spending is projected to rise only modestly, reaching Rs1.2 trillion by FY30, still low relative to the expanding size of the economy.

This prolonged compression of development expenditure raises concerns about infrastructure gaps, productivity growth, and long-term economic competitiveness.

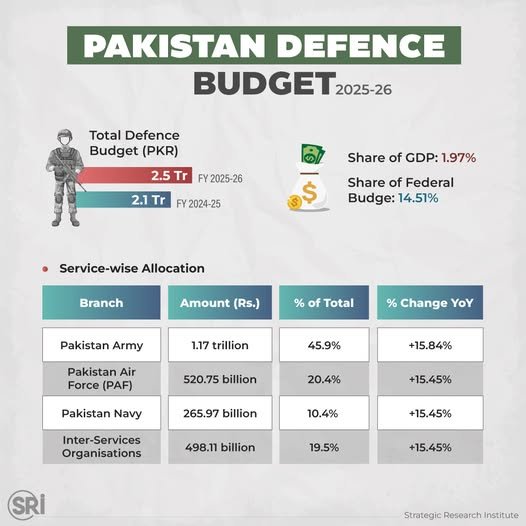

IMF Pakistan Fiscal Projections Signal Rising Defence Spending

In contrast to development spending, defence expenditure is on a clear upward trajectory.

The IMF observed that defence spending declined from 2.4 percent of GDP in FY21 to 1.8 percent in FY24, before recovering to 1.9 percent in FY25. For the current year, it is projected to rise to 2 percent of GDP, a ratio expected to remain unchanged through FY2030.

In absolute terms, defence spending has surged sharply. From Rs1.3 trillion in FY21, it reached Rs2.2 trillion in FY25, reflecting a 67 percent increase in four years. The IMF projects this figure to rise further to nearly Rs4 trillion by FY30, marking an increase of over 80 percent compared to FY25.

IMF-Driven PSDP Reforms and Political Constraints

Under IMF guidance, the government has begun restructuring the PSDP portfolio to improve project selection and prioritisation. The finance minister has committed to:

• Streamlining the PSDP pipeline by Rs2.5 trillion

• Capping new project allocations at 10 percent in the FY27 budget

• Enhancing scorecard-based project evaluation, including climate-related criteria

However, political realities continue to limit reform efforts. The IMF acknowledged its inability to restrict funding for parliamentarians’ constituency schemes under the Sustainable Development Goals Achievement Programme (SAP), which has secured Rs70 billion this year.

Low Development Spending Reflects Fiscal Tightening

The IMF also warned that lower revenues linked to the National Tariff Policy could trigger further cuts or delays in development spending. This explains why PSDP utilisation during the first five months of the current fiscal year stood at just 9.2 percent, with development expenditure 20 percent lower than last year for the same period.

The Planning Ministry confirmed that reduced spending by provinces, special areas, and key ministries particularly railways has weighed heavily on overall development activity.

IMF Pakistan fiscal projections underline a structural imbalance in public spending priorities. While easing interest payments provide some breathing room, shrinking development allocations and rising defence expenditure suggest limited space for growth-enhancing investments posing long-term risks to Pakistan’s economic trajectory.