The All Pakistan Textile Mills Association (APTMA) has formally approached the Federal Board of Revenue (FBR), seeking an extension of at least three weeks for the filing and payment of sales tax returns, citing severe logistical disruptions caused by ongoing transport strikes across the country.

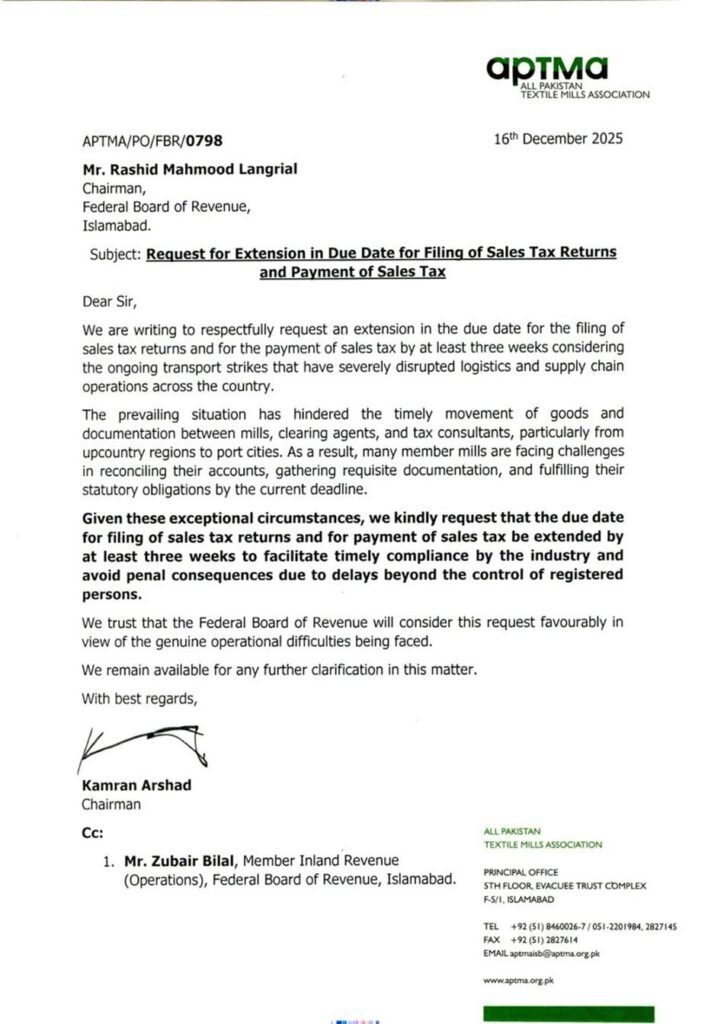

In a letter addressed to FBR Chairman Rashid Mahmood Langrial, APTMA Chairman Kamran Arshad outlined the operational challenges being faced by textile mills due to the breakdown of supply chains and delays in the movement of goods between upcountry regions and major port cities.

Transport Strikes Disrupt Compliance Timelines

According to APTMA, the prevailing transport situation has significantly hampered the timely movement of goods, documents, and essential records between textile mills, clearing agents, and tax consultants. The impact has been particularly acute for mills located in upcountry regions, where access to ports and administrative hubs has been severely restricted.

“The ongoing disruption has made it extremely difficult for member mills to reconcile accounts, compile required documentation, and meet statutory sales tax deadlines,” the association stated in its communication to the tax authority.

Request to Avoid Penal Consequences

APTMA emphasized that the delays are beyond the control of registered taxpayers and warned that failure to extend deadlines could expose compliant businesses to unnecessary penalties and financial strain. The association urged the FBR to consider a minimum three-week extension to facilitate smooth compliance and maintain business continuity.

The textile body expressed confidence that the FBR would take a pragmatic and industry-friendly view of the request, given the genuine operational difficulties currently confronting the sector. APTMA also conveyed its willingness to provide any additional clarification or data required by the tax authorities.

The letter was also copied to Zubair Bilal, Member Inland Revenue (Operations) at the FBR, underscoring the urgency and importance of the matter.

Textile Sector Under Pressure

The textile industry, one of Pakistan’s largest contributors to exports, employment, and industrial output, has repeatedly highlighted logistical bottlenecks as a key factor affecting operational efficiency and regulatory compliance. Industry stakeholders warn that without timely relief, delayed tax filings could have a cascading financial impact on mills already grappling with rising costs and supply chain uncertainties.

APTMA’s request comes at a critical time, as concerns grow over documentation delays and the potential economic fallout if sales tax deadlines are not adjusted in line with ground realities.