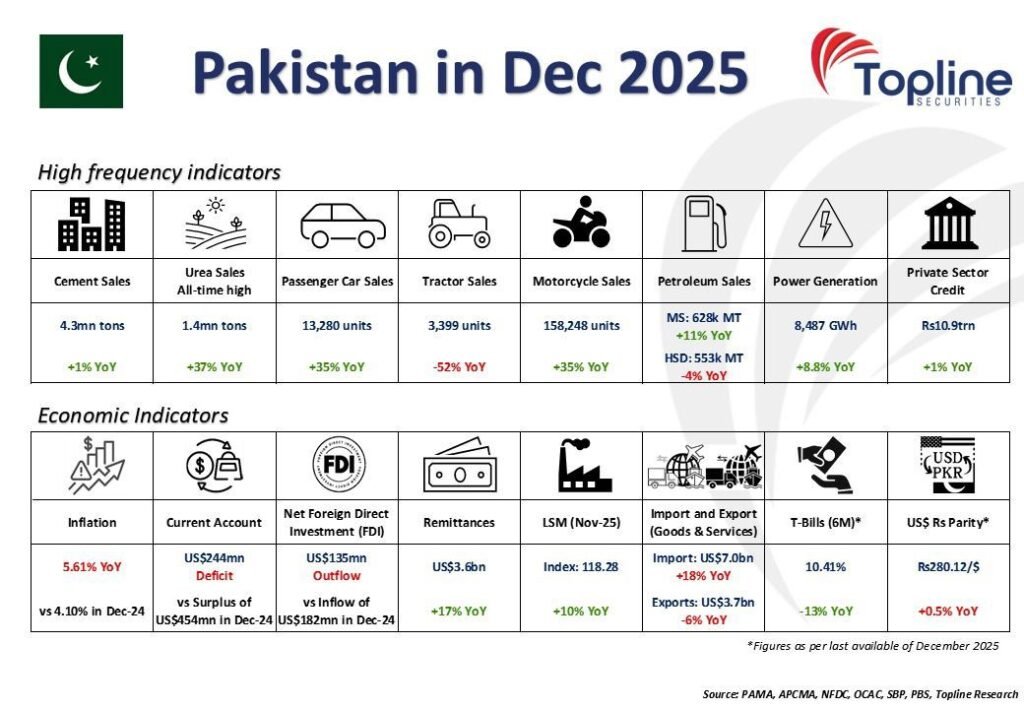

Pakistan’s economy demonstrated strong momentum in December 2025, with key high-frequency indicators reflecting broad-based recovery and improved consumer and industrial demand. Sectors such as automobiles, cement, urea, and power generation posted robust gains, fuelled by new model introductions, infrastructure projects, favourable farm economics, and rising commercial activity.

Remittances remained a key stabilizer, surging to US$3.6 billion (+17% YoY), while large-scale manufacturing (LSM) growth reached 10% YoY. However, external balances showed strain as the current account recorded a US$244 million deficit, driven by a sharp rise in imports outpacing exports.

Sectoral Surge Signals Industrial Rebound

The cement industry maintained healthy dispatches at approximately 4.3 million tons in December 2025, supported by ongoing public infrastructure development and sustained private construction activity. Domestic sales were particularly strong, with northern mills seeing notable increases amid urban and developmental projects.

Urea offtake hit an all-time high of around 1.4 million tons (+37% YoY), driven by improved agricultural profitability, government incentives, and aggressive discounting by manufacturers like Engro and Fauji Fertiliser. This record performance lifted full-year 2025 urea sales to 6.73 million tons (+2% YoY).

In the auto sector, passenger car sales rose 35% YoY to 13.3k units, benefiting from fresh model launches and better supply chains, though volumes dipped month-on-month due to year-end factors. Motorcycle and three-wheeler sales climbed similarly, reaching about 158-160k units (+36% YoY), underscoring demand for affordable mobility.

Power generation increased 8.8% YoY to 8,487 GWh—the second-highest December figure on record—primarily from higher output in coal and RLNG plants, signaling elevated industrial and commercial electricity demand.

Macro Resilience Amid External Headwinds

Remittance inflows of US$3.6 billion provided crucial support to household consumption and foreign exchange reserves, up 17% YoY and contributing to 1HFY26 totals of nearly US$19.7 billion (+11% YoY).Easing inflationary pressures and a softer monetary environment were evident in the 6M T-bill yield falling to 10.41% (-13% YoY), fostering optimism for lower borrowing costs.

Despite these positives, the current account shifted to a US$244 million deficit in December, as imports surged significantly while exports lagged, highlighting vulnerability to global commodity prices and trade dynamics. Overall, December’s data points to resilient domestic activity amid stabilizing macro conditions, though sustained external discipline remains essential for long-term growth.