Pakistan Large-Scale Manufacturing Growth is once again in the spotlight as fresh data for November 2025 reveals a powerful revival in the country’s industrial engine. With factories humming, assembly lines accelerating, and consumer demand strengthening, Pakistan’s manufacturing sector is showing signs of a long-awaited turnaround one that could redefine economic momentum heading into FY26.

Read More: https://theboardroompk.com/pakistan-seafood-exports-record-strong-growth-as-global-demand-bites/

According to provisional figures based on the 2015–16 base year, the Quantum Index of Manufacturing (QIM) climbed to 118.28 in November 2025, reflecting sustained industrial expansion. Large-Scale Manufacturing Industries (LSMI) posted an impressive 10.37% year-on-year growth, while maintaining stability with a 0.16% month-on-month increase compared to October.

But behind these numbers lies a deeper, more compelling story of sectoral leadership, resilience, and shifting economic dynamics.

Pakistan Large-Scale Manufacturing Growth: The Bigger Picture

Between July and November FY26, Pakistan’s manufacturing output expanded by 6.01% cumulatively, with the QIM averaging 115.72, significantly higher than 109.65 recorded in the same period last year. This steady rise highlights strengthening domestic demand and improving industrial confidence despite lingering macroeconomic challenges.

What makes this growth particularly striking is the breadth of sectoral participation, led by automobiles, petroleum products, garments, cement, and beverages.

Automobiles Lead Pakistan Large-Scale Manufacturing Growth

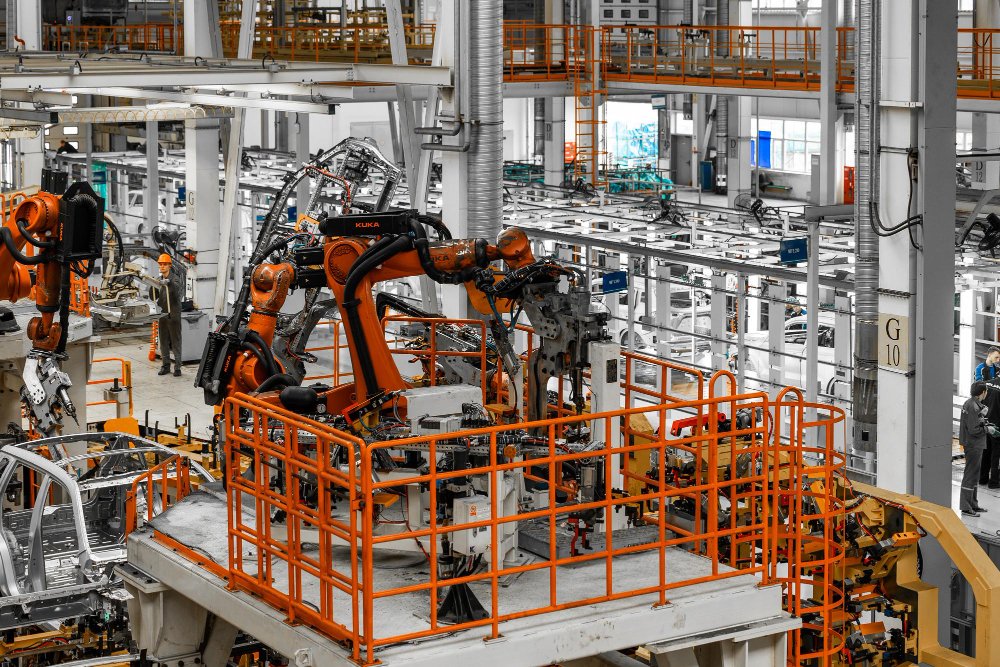

No sector captured attention quite like automobiles. In November alone, automobile production surged by 61.35%, while cumulative output between July and November skyrocketed by an astonishing 75.15%.

This remarkable expansion reflects easing supply constraints, improving financing conditions, and renewed consumer appetite especially for locally assembled vehicles. Automobiles alone contributed 1.77 percentage points to overall manufacturing growth, making them the single largest driver of industrial recovery.

Petroleum Products and Energy Demand Power Ahead

Another key pillar of Pakistan Large-Scale Manufacturing Growth was petroleum products, which recorded a robust 43.66% year-on-year increase in November. Over the five-month period, the sector expanded by 18.06%, driven by rising transportation activity and industrial energy needs.

Petroleum products contributed 1.29 percentage points to cumulative manufacturing growth, underscoring their strategic importance to both industry and the broader economy.

Garments, Cement, and Construction Signal Demand Revival

The garments sector delivered strong momentum with 18.43% growth in November and 7.14% cumulative expansion, reflecting improving export orders and domestic retail demand.

Meanwhile, cement production grew 8.74% in November, pushing cumulative growth to 13.47% during July–November FY26. This expansion mirrors renewed activity in construction and infrastructure, often considered a bellwether for economic confidence.

Together, garments and cement added more than 2 percentage points to overall manufacturing growth.

Mixed Signals Across Other Manufacturing Segments

Beverages recorded an exceptional 32.61% increase in November, while textile products posted a modest yet steady 2.52% monthly improvement, indicating gradual normalization in traditional industries.

However, not all sectors shared the upswing. Iron and steel production declined 5.99% in November and 3.80% cumulatively, reflecting cost pressures and subdued large-scale construction demand. Pharmaceuticals contracted 5.31% during July–November, while machinery and equipment output fell sharply by 16.37% in November, signaling investment hesitancy in capital-intensive segments.

Sectoral Contributions: Who Drove Pakistan Large-Scale Manufacturing Growth?

The cumulative 6.01% growth was primarily driven by:

• Automobiles

• Petroleum products

• Garments

• Cement

• Food manufacturing

• Textiles

These gains were partially offset by declines in pharmaceuticals and iron & steel products, highlighting the uneven nature of industrial recovery.

What Pakistan Large-Scale Manufacturing Growth Means for the Economy

The sustained momentum in Pakistan Large-Scale Manufacturing Growth points toward improving economic conditions, rising consumer confidence, and stronger domestic demand—particularly in automobiles and construction-linked industries.

Yet, the uneven sectoral performance signals the need for targeted policy interventions to support lagging industries and ensure a broad-based, sustainable industrial revival.

If current trends persist, Pakistan’s manufacturing sector could emerge as a key growth engine in FY26 fueling employment, exports, and long-term economic stability.