Islamabad, December 22, 2025 – The Auditor General of Pakistan (AGP) has officially initiated the transition from the current cash-based government accounting system to an accrual-based framework, marking a landmark reform in public financial management.

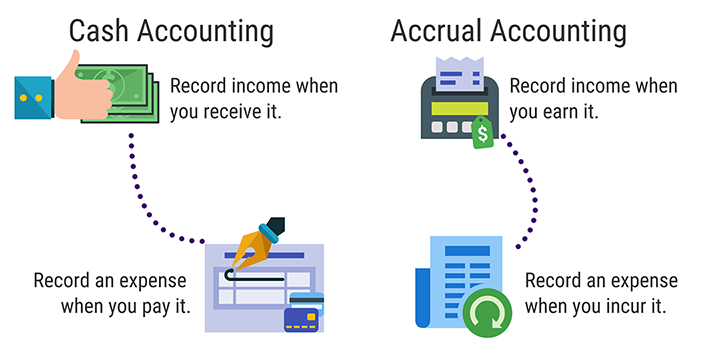

Currently, Pakistan’s government accounts, prepared on a cash basis since 2000, record transactions only when cash is received or paid. In contrast, accrual-based accounting recognizes revenues when they are earned and expenses when they are incurred, regardless of when actual cash changes hands. For instance, if a government department provides services in one fiscal year but receives payment in the next, accrual accounting records the revenue in the year the service was delivered. This method provides a more comprehensive view of financial position, including assets, liabilities, receivables, and payables, leading to greater accuracy in assessing fiscal health.

Understanding Accrual-Based Accounting Accrual accounting, aligned with International Public Sector Accounting Standards (IPSAS), offers a fuller picture of government finances compared to cash-based systems, which can distort long-term obligations like pensions or debts. It enhances transparency by revealing true economic impacts of policies and improves decision-making through reliable data on commitments and resources.

The AGP, exercising authority under Article 170 of the Constitution, is leading the review with technical assistance from the World Bank. The new standards will apply uniformly to federal, provincial, and local governments upon presidential approval. This move underscores the government’s commitment to fiscal discipline, accountability, and better governance.

Officials stated that the shift will significantly elevate the quality of financial reporting, aligning Pakistan with global best practices for the first time.