Karachi, December 15, 2025 – Independent Power Producers (IPPs) in Pakistan, long undervalued amid sector reforms, are sparking investor excitement through bold diversification moves. According to a latest research note from Arif Habib Limited, companies like Nishat Power Limited (NPL), Nishat (Chunian) Power Limited (NCPL), and Kot Addu Power Company (KAPCO) are transitioning beyond traditional power generation, fueling significant stock gains and attractive dividend prospects.

NPL and NCPL Accelerate into Electric and Hybrid Vehicles

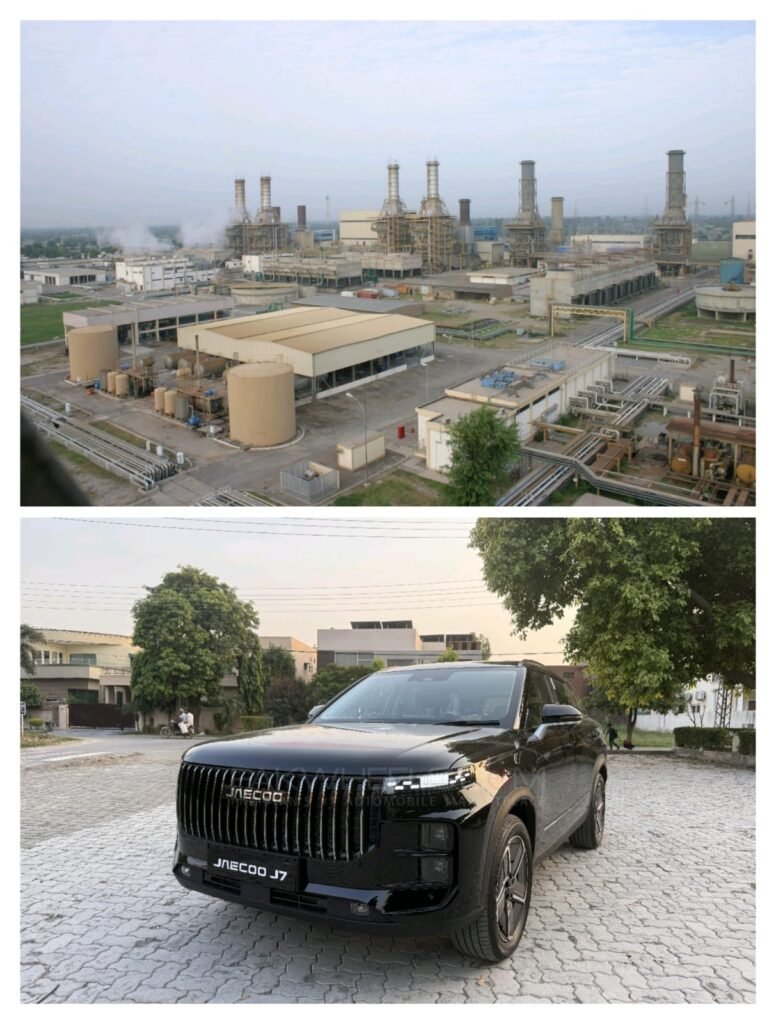

NPL and NCPL have surged 54% and 80% respectively since announcing their entry into the booming auto sector via NexGen Auto – a joint venture planning to launch new energy vehicles (NEVs) in partnership with the Nishat Group and Chery International.

The flagship models include the Jaecoo J7 plug-in hybrid electric vehicle (PHEV), aggressively priced at PKR 10.5 million, and the fully electric Omoda E5 SUV at PKR 8.9 million. The Jaecoo J7 has already seen blockbuster demand, with reports of 3,500 bookings shortly after launch – one of the strongest responses for a new entrant in Pakistan’s automotive market.

NexGen Auto is investing heavily, including PKR 14.7 billion for a new CKD assembly plant with 32,000 units annual capacity. Analysts project this venture could add over PKR 30 per share in value to NPL and NCPL, with incremental earnings upside of PKR 2.8–3.3 per share in coming years.

Both companies benefited from power sector reforms, recovering billions in receivables under new “Hybrid Take-and-Pay” agreements. This has bolstered balance sheets, enabling high dividend yields of around 9–10% expected for FY27–28.

KAPCO’s Turnaround: PPA Renewal and Cement Ambitions

KAPCO, operator of Pakistan’s largest multi-fuel power plant, has staged a remarkable recovery. After 12 quarters of gross losses, its Power Purchase Agreement (PPA) for 500 MW has been reinstated for three years under a hybrid model, paving the way for profitability.

The company holds a massive PKR 39.7 billion in cash (PKR 45/share) after clearing debts and receivables. KAPCO shares have risen 21% on news of a binding offer, jointly with Fauji Foundation, to acquire an 84% stake in Attock Cement Pakistan Limited (ACPL).

ACPL reported strong Q1FY26 results with 61% YoY dispatch growth and margins expanding to 29%. The deal could add PKR 1.9–2.4 per share to KAPCO’s earnings, while maintaining high dividend yields of 13.7%.

Arif Habib analysts view these moves as catalysts for re-rating overlooked IPPs, trading at deep discounts despite robust fundamentals. With Pakistan’s SUV market share rising to 17% and cement demand recovering, these diversifications signal a new growth chapter for the sector.