The KSE-100 Index extended its corrective phase on Monday, closing sharply lower as heavyweight sectors including commercial banks, oil & gas exploration, cement, and fertilizers came under selling pressure. Investor sentiment remained cautious despite strong year-to-date gains, leading to profit-taking across most index constituents.

By the end of the trading session, the KSE-100 Index settled at 182,384.14 points, marking a decline of 2,025.53 points or 1.10% on a day dominated by negative breadth and sector-wide weakness.

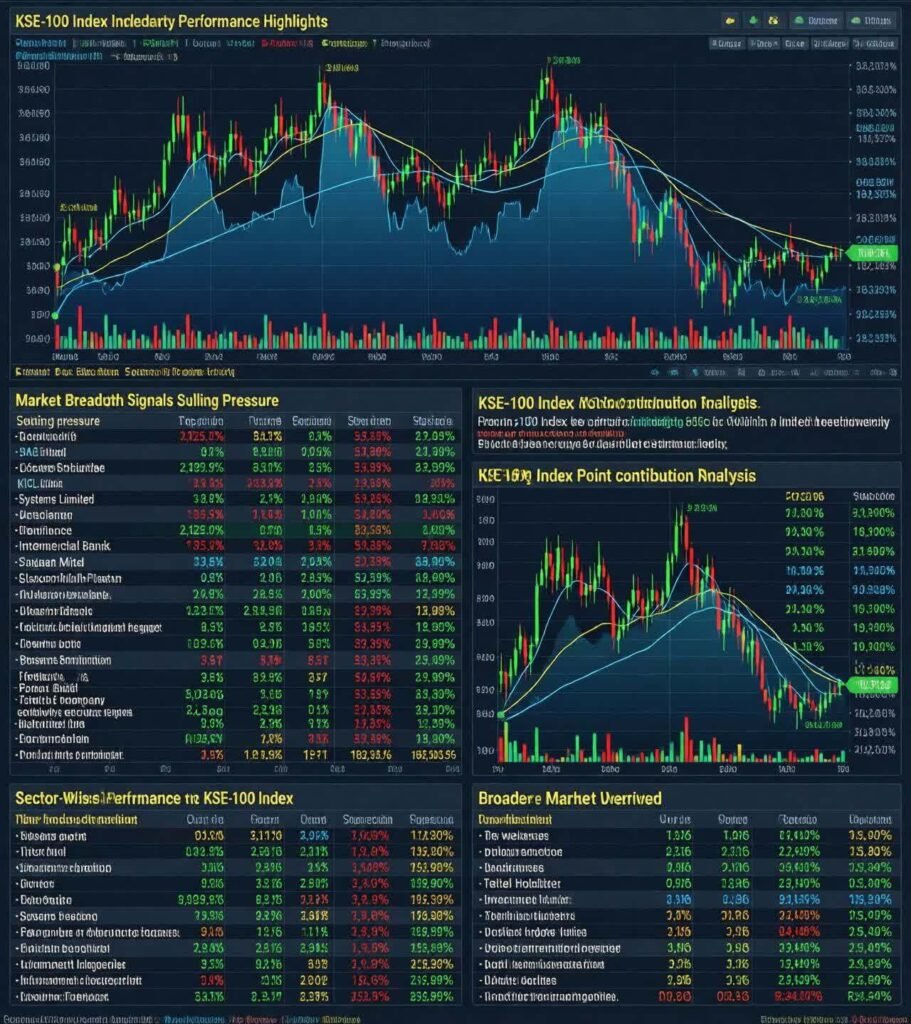

KSE-100 Index Intraday Performance Highlights

The KSE-100 Index experienced heightened volatility throughout the session, moving within a wide intraday range of over 2,100 points. The index briefly touched an intraday high of 184,439.06 points, before selling pressure intensified, dragging it down to a low of 182,303.56 points.

Market participation remained active, with 418.83 million shares traded within the benchmark index, indicating sustained investor engagement despite the bearish close.

Market Breadth Signals Strong Selling Pressure

Out of the 100 companies comprising the KSE-100 Index, market breadth remained decisively negative. Only 18 stocks closed in the green, while 81 stocks ended lower, and one stock remained unchanged, reflecting broad-based selling across sectors.

Top Losers and Gainers in the KSE-100 Index

Selling pressure was most pronounced in select blue-chip and growth stocks. The worst-performing stocks included insurance, technology, cement, and pharmaceutical names. Meanwhile, selective buying interest emerged in textiles, telecom, and chemicals.

Stocks that declined the most were led by AICL, which shed nearly 8%, followed by SAZEW, KOHC, Systems Limited, and GlaxoSmithKline Pakistan. On the positive side, Nishat Mills, Pakistan Telecommunication Company, and Lotte Chemical Pakistan posted strong gains, helping cushion the index from steeper losses.

KSE-100 Index Point Contribution Analysis

From an index-point perspective, the downward move in the KSE-100 Index was largely driven by heavyweight stocks. Systems Limited, United Bank Limited, Meezan Bank, Engro Holdings, and Fauji Fertilizer Company collectively erased several hundred points from the benchmark.

Conversely, support to the index came primarily from PTC, Nishat Mills, Askari Bank, Lotte Chemical, and Millat Tractors, which added modest points but were insufficient to offset broader losses.

Sector-Wise Performance of the KSE-100 Index

The KSE-100 Index was primarily dragged lower by the commercial banking sector, which contributed the largest negative impact. This was followed by oil & gas exploration, investment companies, cement, and fertilizer sectors, all of which faced notable selling pressure.

On the supportive side, textile composite stocks provided limited relief, while marginal gains were recorded in REITs, woollen, sugar & allied industries, and leasing companies, though their overall contribution remained minimal.

Broader Market Overview

The weakness extended beyond the benchmark, as the All-Share Index closed at 109,499.62 points, down 882.96 points or 0.80%. Total market volume rose to 1.06 billion shares, reflecting increased activity, while traded value declined to Rs48.24 billion, indicating cautious positioning.

Across the broader market, 161 stocks advanced, 284 declined, and 36 remained unchanged, reinforcing the bearish undertone.

Long-Term Performance Keeps Investor Optimism Alive

Despite the short-term correction, the KSE-100 Index has delivered impressive long-term returns. During the current fiscal year, the index has surged by 56,757 points, representing a gain of 45.18%. On a calendar-year basis, it remains up 8,330 points or 4.79%, highlighting the underlying strength of Pakistan’s equity market.

Outlook for the KSE-100 Index

Market participants are likely to remain selective in the near term, focusing on earnings visibility, interest rate expectations, and macroeconomic signals. While volatility may persist, strong fiscal-year performance suggests that any further dips in the KSE-100 Index could attract value-based buying.